when is capital gains tax increasing

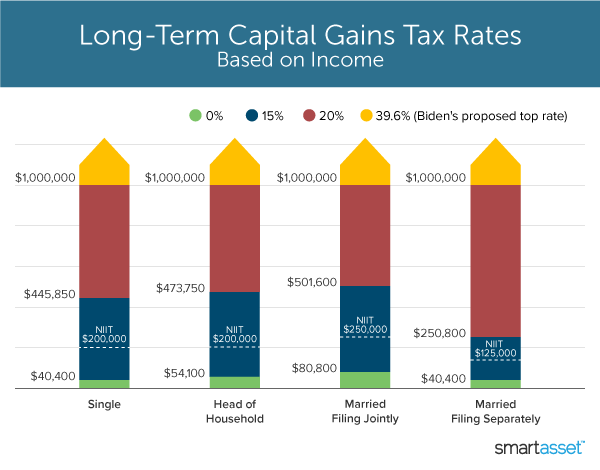

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. Both have proposed increasing tax rates for capital gains as one potential way to generate revenue for this purpose.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Potential employment would drop by 270000 in 2011 and 413000 in.

. Note however that proposal also calls for an increase in ordinary income rates to a top rate of 396. The long-term capital gains tax rate is typically 0 15 or 20 depending on your tax bracket. While it technically takes effect.

Earlier such tax was 5 per cent. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. Capital gains tax has been increased by the government in the budget presented in the Parliament.

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. When including the net investment income tax the top federal rate on capital gains would be 434 percent.

Youll owe either 0 15 or 20. There is currently a bill that if passed would increase the. Understanding Capital Gains and the Biden Tax Plan.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. The Chancellor will announce the next Budget on 3 March 2021. The proposed capital gains tax reforms of which any Budget.

The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987 and by 40 in 2012 in anticipation of the increased maximum tax rate from 15 to 25 in 2013. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. In 1978 Congress eliminated the minimum tax on excluded gains and increased the exclusion to 60 reducing the maximum rate to.

One prominent proposal would be to tax capital gains as they accrue instead of waiting until an. Capital gains tax rates on most assets held for a year or less correspond to. As per the new provision the sale of a house or land owned for less than five years will now attract 75 per cent capital gains tax on gains.

That applies to both long- and short-term capital gains. From 1954 to 1967 the maximum capital gains tax rate was 25. The bottom 99 on.

One approach to both reduce inequality and raise revenue is to reform the taxation of capital gains. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. The state Tax Department estimates that bill would raise an extra 165 million for the state in 2024 even after deducting the cost of the tax credit and that tax windfall would increase to more.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Implications for business owners. Were going to get rid of the loopholes that allow Americans who make more.

For single tax filers you can benefit from the zero percent. As a reminder the proposal calls for taxing long-term capital gains at ordinary income rates for high-income individuals and trusts 408 being the highest capital gains rate with a 37 income tax rate and the 38 net investment income tax. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. You do not have to pay capital gains tax until youve sold. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic. Increasing capital gains and dividend tax rates would reduce the capital stock by 12 billion in constant 2000 dollars by 2012. Long-term capital gains or appreciation on assets held for more than one year are taxed at a lower rate than ordinary income when realized.

The capital gains tax is based on that profit. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Hawaiis capital gains tax rate is 725.

For instance the top individual income tax rate for individuals making more than. Similarly 5 per cent capital tax will be levied on the sale of a house. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20.

The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners. Long-Term Capital Gains Taxes.

Capital Gains Meaning Types Taxation Calculation Exemptions

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How To Save Capital Gain Tax On Sale Of Residential Property

House Democrats Propose Hiking Capital Gains Tax To 28 8

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Double Taxation Definition Taxedu Tax Foundation

Tax Advantages For Donor Advised Funds Nptrust

Selling Stock How Capital Gains Are Taxed The Motley Fool

2021 Capital Gains Tax Rates By State

Smart Super Strategy 4 Manage Capital Gains Tax Capital Gains Tax Capital Gain Smart

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)